Get Started With

servzone

Overview

Recently, RBI compliance has become more complex for NBFCs. There used to be a time when non-banking financial companies used to get benefits in banks. There was a time when NBFC compliance was very simple and lenient but after the Sahara case, RBI drafted new compliance for NBFCs and placed them under its screening. Part of the important rules are guidelines for securitization of standard assets and private placement of NBFCs. RBI is continuously trying to circumvent the principle in NBFCs.

Non-banking financial companies are registered under the Companies Act 2013, and are involved in the business of acquiring deposits, loans and advances, stock / bonds / shares, debentures and securities issued by the government. NBFCs are actively involved in financial activities and are registered by the Reserve Bank of India. No NBFC can run its business without obtaining license from Reserve Bank of India.

Term ‘Principal Business’

The term ‘Principal Business’ stands for those financial activities where a company’s financial assets comprises of more than 50 percent of the total assets and income from financial assets derive is more than 50 percent of the gross income.Any company that meets both these criteria is eligible to be registered as an NBFC. Although the core business is not defined by the RBI, the RBI has made it clear that companies involved in financial activities can be registered and supervised by the RBI. Therefore, those companies which cannot regulate and supervise agriculture, sale and purchase of goods, construction of real estate, sale of real estate, industrial activity by RBI, as they do not fall under the norms of NBFCs. >

Applicable regulations for asset size is less than ₹ 500 Crore

In the event that NBFC has no access to public funds and has no client interface, it will not come into contact with any guidelines that either lead to prudential or business guidelines.

If customer funds are not getting access to public funds, then NBFCs with customer interface will be specifically exposed to financial guidelines including FYC, KYC. As they are taking place for open property, they will be made aware of restricted prudential guidelines.

NBFCs that are connected to both open asset and customer interfaces are exposed to both limited discretionary and business guidelines.

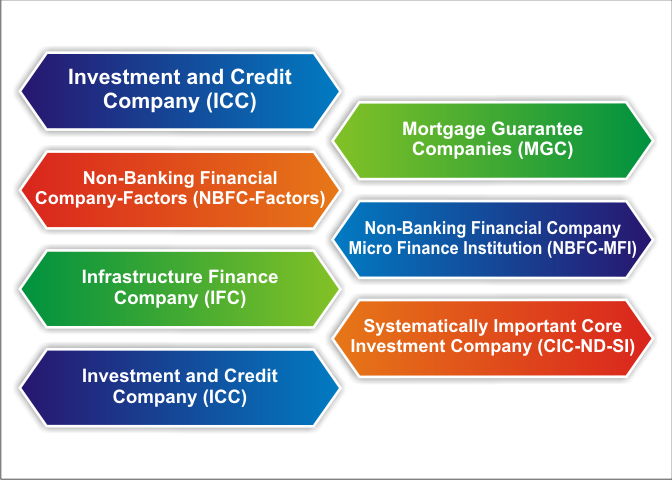

Different categories

Types of NBFCs

Types of returns

Carrying Return NBFC by Deposit

- NBS -1

These are quarterly returns on deposits in the first schedule. Such returns need to be equipped for the purpose of capturing financial statements such as profit and loss accounts, assets and components of liability. / />

- NBS -2

Quarterly returns on prudential norms. The requirement of filing this return is for obtaining details related to several criteria like asset classification, capital adequacy, NOF, provisions etc.

- NBS -3 Quarterly Return on Liquid Assets. The motive behind filing such criteria is to get information about statutory investment in liquid states.

- NBS -4

Annual return of critical parameters by rejected companies that are making public deposits. The purpose behind filing this return is to find out the repayment status of the rejected NBFCs accepting public deposits.

- NBS -6

Requires to be filed as a monthly return on exposure to the capital market by depositing NBFCs with total assets of Rs. 100 crores or more.

- ALM Return

These returns are filed half-yearly by NBFCs as deposits amounting to more than Rs. Property worth more than 20 crores or property size 100 crores.

1. Requires Audited Balance Sheet and Auditor’s Report by NBFC accepting public deposits, to be furnished;

2. Branch information related returns

Return by non-deposit NBFC

- NBS-7

This is a quarterly statement that provides information related to risk asset ratio, capital fund, risk weighted assets.

- NBS -2

Such return is the monthly return on an important financial parameter of NBFC-ND-SI.

- ALM Return

1. Statement of short-term dynamic liquidity in NBS-ALM-1

format monthly2. Description of structural fluidity in half-yearly format NBS-ALM2

3. Description of interest rate sensitivity in half-yearly format NBS-ALM-3

- Return Branch Information

Quarterly returns on key financial parameters of NBFCs of non-deposits are assets of ₹ 50 crores and above, but less than ₹ 100 crores. During the last three years the requirement like name, address, net ownership fund, profit / loss of the company should be furnished quarterly by non-deposits with a size of assets between NBFCs between ₹ 50 crores and ₹ 100 crores. Should be taken.

Event Based Compliances

Post incorporation

Once you get the core from the Reserve Bank of India, it is time for NBFCs to become members of all credit credit information companies.

- Adopting Fair Practice Code

The Reserve Bank of India revealed its round on September 28, 2006, stipulating rules on Fair Practice Code (FPC) for all NBFCs to be embraced by them while doing lending business. The rules secured general standards on adequate exposure to the terms and conditions of a loan and subsequently embraced a non-coercive recruitment strategy.

- CIC Registration

In India, the companies below are considered as credit information companies

- CIBIL-Credit Information Bureau India Limited

CIBIL was introduced as India’s first Credit Bureau. To receive his/her credit score the person has to do a login onto the CIBIL website and provide the required details in an online form, the person will receive the credit score on the registered email id.

- Equifax Credit Information Services Private Limited

Equifax has entered its services in India in the year 2010 and has recorded a lofty development by collecting and absorbing records of a person's monetary information and further helps in dealing with the financial profile of individual buyers.

- Experian Credit Information Company of India Private Limited is

Experian performs a credit check on its consumers and shows the possibility of paying a consumer his loan and credit ability.

- CRIF High Mark Credit Information Services Private Limited is The purpose of

CRIF High Mark is to ensure that the customer is trustworthy and that there will be no flaws in future operations. Mainly banks and lenders prefer credit rating companies.

- FIU-IND Registration

Every NBFC, post incorporation requires financial intelligence registration. This is required to provide their customer details as provided in the Prevention of Money Laundering Act. The reason behind registering FIU-IND is to provide quality financial intelligence with the objective of protecting the financial system from financial activities related to finance and other crimes which may involve money laundering.

- Central KYC Registration

Many NBFCs are quickly adopting Central KYC registration, one of the most important being NBFC compliance. The purpose of CKYC is to collect records for customers in financial services. CERSAI which stands for Central Registry of Securitization and Asset Reconstruction and Security Interest, CERSAI is the Registry Authority for Central KYC.

It is necessary for all NBFCs to obtain central KYC registration to reduce the burden of the unit. - CERSAI

CERSAI is additionally known as the Central Registry of Securitization Asset Reconstruction and Security Interest of India. CERSAI is formed by the Government of India as an organization under Section 8 of the Companies Act, 2013.

CERSAI was prepared to identify and investigate any fraudulent activities during the loan transaction process against similar mortgages. At the end of the day, CRESAI was established to demolish and prevent the act of taking out separate loans from certain banks utilizing the same resources or assets.

- Presentation of Financial Information to Information Utility

Section 215 of the IBC, 2016 gives ways for housing financial information by lenders.

- It is compulsory for creditors to submit financial data and data identifying resources, corresponding to which a security plan has been made.

- The operational creditor requires that the money data be presented to the information utility in a form that is indicated.

Therefore, anyone who expects this:

- Presenting financial data to a data utility; Or

- Get access to information from data utility

will pay the fee and submit the data in such a form and manner as may be indicated by the guideline.

Annual compliance

- NBS-9-Filling of Return with RBI

NBFCs-ND file for NBS-9 and that’s too in case where there asset size is less than Rs 100 crore.

- Call a constitutional meeting

The statutory meeting is called so that investors can get an open door to see what level of progress has completed the organization and everyone floating together whether any unusual issues to support them Can be kept

The statutory assembly is organized to advise investors on matters related to advice, suspension, allocation of proposals, run by the organization, use of assets, etc.

- Maintenance of Accounts

Books of accounts including vouchers and receipts are required to be kept up under various legal laws – Income Tax Act, Companies Act 2013 and GST Act. Books to be kept up, maintenance period and compulsion necessities are distinctive under all the 3 laws.

- GST Return Filing

A return is a record containing the fineness of the salary that a citizen has to file with the tax administration authorities. It is used by tax authorities to ascertain tax liability.

Under GST, a listed vendor must record GST returns which include:

purchasing

Sales

GST (on sale)

Input Tax Credit (GST paid on purchase)

GST file returns cannot be filed without sales and purchase invoices.

- Income Tax Return Filing

An Income Tax Return (ITR) is a structure used to record data about your payments and expenses to the Income Tax Department. The expenditure risk of a citizen depends on their salary. In the event that the return shows that a higher amount of tax has been paid during a year, the person will be eligible to receive income tax return from the Income Tax Department at that time.

As per Income Tax laws, it is necessary to file a return every year by a person or business who receives any income during a monetary year. This compensation can be earned through compensation, business benefits, payments or profits from house property, capital additions, premiums or various sources. / />

All NBFCs incorporated under the Companies Act, 1956 are required to file their annual financial statements with the MCA.

- Annual Return Filing

Form AOC-4 NBFC (IND AS) & MGT-7 is used to file annual return with Registrar of Companies (ROC) within 30 days & within 60 days from conclusion of annual general meeting respectively.

GST Registration

PVT. LTD. Company

Loan

Insurance